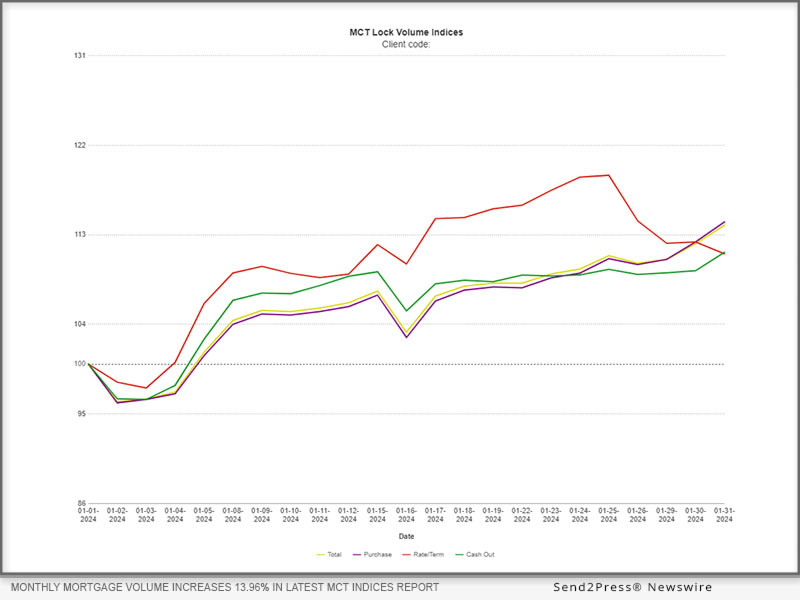

SAN DIEGO, Calif. /California Newswire/ — Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today an increase of 13.96% in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

For the first time since June 2023, MCT® has observed month-over-month growth in total volume, purchase volume, rate/term refinances, and cash-out refinances. These figures come as the Federal Reserve has decided to maintain interest rates at their current level, with indications that a March rate cut may be unlikely as they persist in their pursuit of achieving 2% inflation.

While the rise in monthly volume across the board is a notable trend, the year-over-year comparison reveals relatively stable total volume. Phil Rasori, Chief Operating Officer at MCT, commented on the current landscape, stating, “The recent decrease in mortgage rates and increase in refinance volume hasn’t yet made a meaningful impact compared to a year ago. However, we anticipate a shift in this scenario as we approach a potential Fed rate cut, unlocking the potential for increased refinance and total volume.”

To access the comprehensive insights provided by MCT’s Lock Volume Indices, interested parties are encouraged to download the full report – https://mct-trading.com/press-release/monthly-mortgage-volume-increases-13-96-in-latest-mct-indices-report/.

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to thrive under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

MULTIMEDIA:

Image link for media:

https://mct-trading.com/wp-content/uploads/2024/02/mct-lock-volume-indices-7.png

Caption: Monthly Mortgage Volume Increases 13.96% In Latest MCT Indices Report

Learn More: https://mct-trading.com/

This version of news story was published on and is Copr. © 2024 California Newswire® (CaliforniaNewswire.com) – part of the Neotrope® News Network, USA – all rights reserved.

Information is believed accurate but is not guaranteed. For questions about the above news, contact the company/org/person noted in the text and NOT this website.

Originally published on CaliforniaNewswire.com — Monthly Mortgage Volume Increases 13.96% In Latest Feb. 2024 MCT Indices Report